W9 Tax Form Explanation

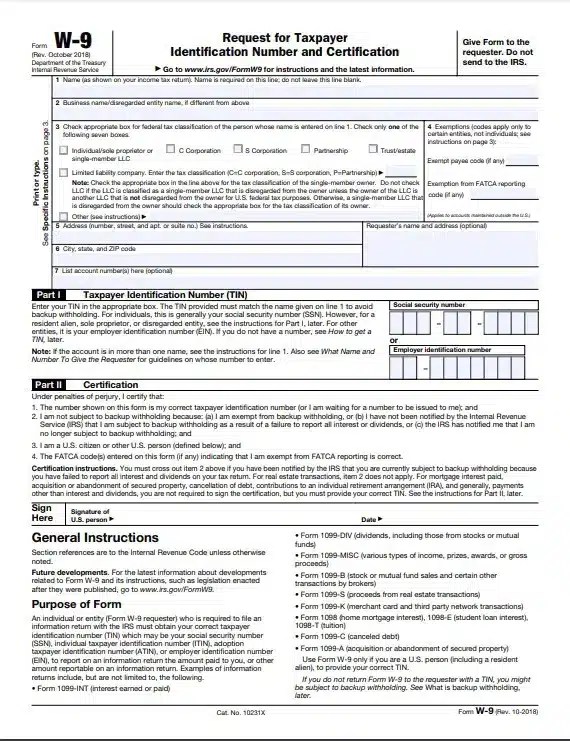

W9 Tax Form Explanation – Complete the basic information in section one. Section references are to the internal revenue code unless otherwise noted. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien. Employers use this form to get the taxpayer identification number (tin) from contractors, freelancers and vendors.

And contributions to an ira. Make sure you've got the right form. You may receive the form from the client or company that hired you. Acquisition or abandonment of secured property;

W9 Tax Form Explanation

W9 Tax Form Explanation

March 2024) request for taxpayer identification number and certiication. This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Contained in the saving clause of a tax treaty to claim an exemption from u.s.

It is also used to collect information from partnerships, corporations, companies, estates,.

How to Complete a W‐9 Tax Form 9 Steps (with Pictures)

How to Complete a W‐9 Tax Form 9 Steps (with Pictures)

W9 Form 2022 PDF download, view or print Why need Form W9? in 2022 Internal revenue service

How to Complete a W‐9 Tax Form 9 Steps (with Pictures)

IRS W9 FORM STEPBYSTEP TUTORIAL How To Fill Out W9 Tax YouTube

W9 What Is It and How Do You Fill It Out? SmartAsset

Quick Video on w9 Form 10 Most Important Things You Must Know

THE Working W9 Tax Form Template

W9 tax form explained 7 mustknow facts and how to fill it in

How to complete IRS W9 Form W 9 Form with examples YouTube

Fillable W 9 Tax Form Printable Forms Free Online

W9 Form Explained Uses and How to Fill It Out

The W9 Requirement Libsyn

Fill And Sign W9 Form Online for Free DigiSigner