W9 Tax Form Explained

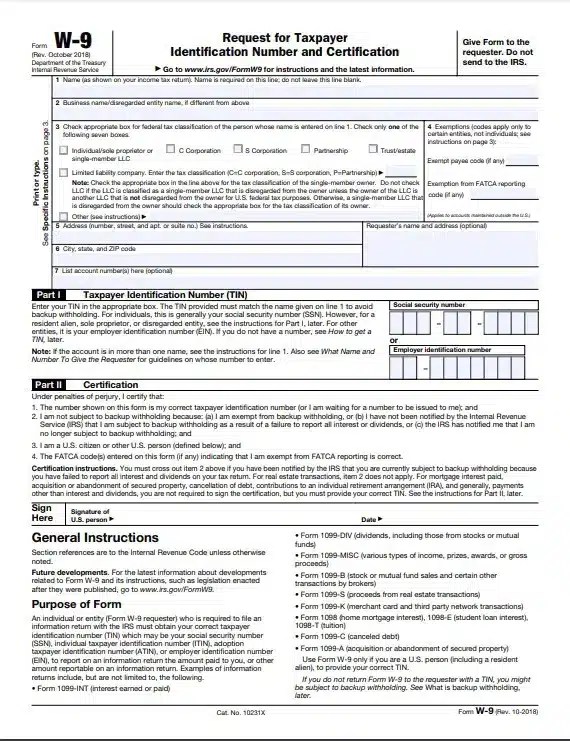

W9 Tax Form Explained – Request for taxpayer identification number and certification. Make sure you've got the right form. You may receive the form from the client or company that hired you. Any entity who hires freelancers or independent.

The form is used to convey form 1099 information to taxpayers working as independent. Track expenses, identify tax deductions, and estimate quarterly taxes. It’s easy to confuse the two, as they both have to do with taxes and your independent. Your tin can be the employer identification.

W9 Tax Form Explained

W9 Tax Form Explained

March 2024) department of the treasury internal revenue service. The companies you work with do not have to withhold. Two of the most common nonemployee tax forms are w9s and 1099s.

This form is not submitted to the irs but is used by various.

THE Working W9 Tax Form Template

W9 tax form explained 7 mustknow facts and how to fill it in

Form W9 India Dictionary

W9 Form Explained Uses and How to Fill It Out

What Is a W9 Tax Form? H&R Block

Why does seller fill out w9? real estate texas what do real estate agents use w9 form for

IRS W9 FORM STEPBYSTEP TUTORIAL How To Fill Out W9 Tax YouTube

How to Complete a W‐9 Tax Form 9 Steps (with Pictures)

The W9 Requirement Libsyn

W9 vs. W2 vs. W4 Forms The Different Tax Forms Explained

Free IRS Form W9 (2024) PDF eForms

How to Fill Out a W9 Form for a Nonprofit — Altruic Advisors

How to Complete a W‐9 Tax Form 9 Steps (with Pictures) wikiHow

W9 What Is It and How Do You Fill It Out? SmartAsset