W9 Tax Form Estate Trust

W9 Tax Form Estate Trust – And contributions to an ira. Acquisition or abandonment of secured property; Name is required on this line; Line 2 is for business name/disregarded entity name, if different than above.

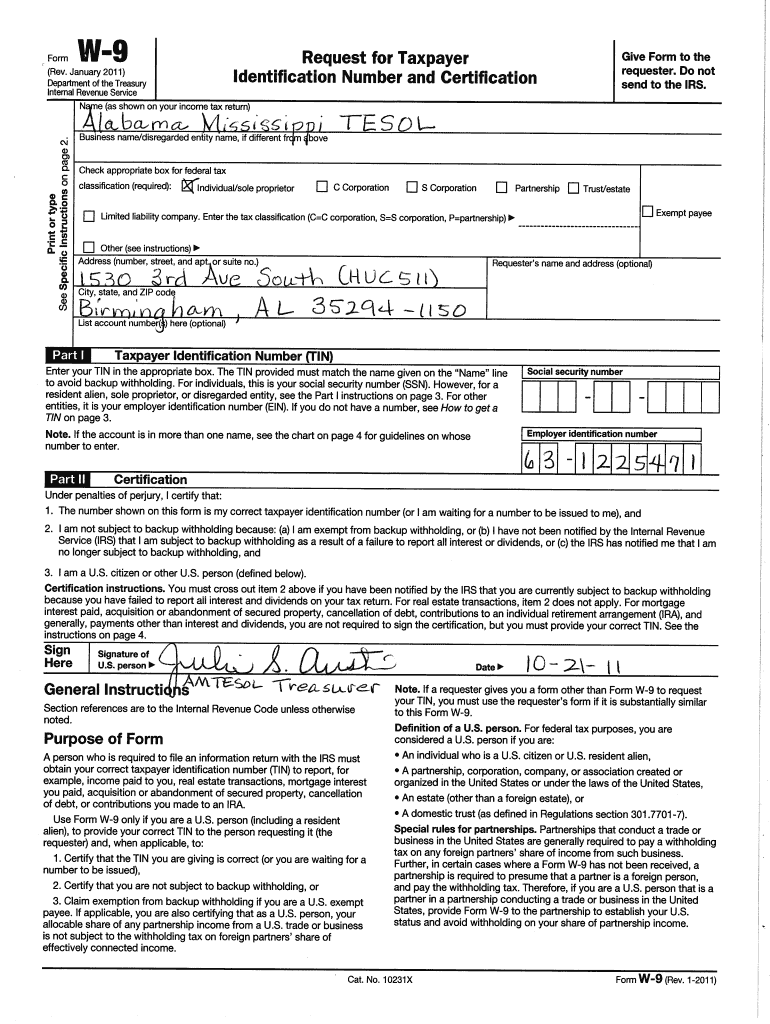

This is from my fathers estate. Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s. This form helps determine whether your estate is subject to federal estate tax and, if so, the potential liabilities. This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:

W9 Tax Form Estate Trust

W9 Tax Form Estate Trust

Form 706 can also serve as a blueprint for proactive tax planning. Trusts/estates subject to the portland business license tax, multnomah county business income tax, metro supportive housing services (shs) business income tax, and/or clean energy surcharge (ces) must file a business tax return. From navigating recent regulatory changes and other guidance from the government to understanding the latest case law updates, we will review these developments in order to help you stay ahead of the curve in an ever.

If the answer to 1 is yes , why wasn’t i required to fill one out last year when i received a partial distribution? File your trust and estate business tax returns. If you are receiving income or benefits from a family trust, those benefits are generally taxable.

If you are a u.s. So i’m guessing john smith goes on line 1. Request for taxpayer identification number and certification go to www.irs.gov/formw9 for instructions and the latest information.

If you are a u.s. During this cast, professionals from washington national tax will discuss the latest estate, gift, and trust planning developments. It’s about checking whether the payee would be subject to backup withholding, which is basically a process whereby the irs can take a cut of some payment to you, even though the payment itself is not taxable, and credit it against whatever tax liability you otherwise have.

Blank Printable W9 Form

How do I fill out IRS Form W9 for my IRA LLC? Rocket Dollar

Irs W9 Form 2021 Printable Calendar Template Printable

W9 Forms 2017 Example Example Calendar Printable

Downloadable Form W 9 Printable W9 Printable Pages In 2020 With Free Riset

How To Prepare A W9 Tax Form YouTube

Pdf Fillable W9 Form Printable Forms Free Online

W9 Tax Form Blank Printable Printable Forms Free Online

Pdf Fillable W9 Form Printable Forms Free Online

What Is a W9 Form & How to Fill It Out

IRS W9 FORM STEPBYSTEP TUTORIAL How To Fill Out W9 Tax YouTube

Fill And Sign W9 Form Online for Free DigiSigner

Ohio W9 Form 2023 Complete with ease airSlate SignNow

W9 Form Download W9 Form 2024 PDF How to fill out the W9 form