Updating Addres On W9 Form

Updating Addres On W9 Form – First, your client must add you to their quickbooks account. Thank you for joining the forum. If you are a u.s. If the payee has marked their address “new,” you should update your records.

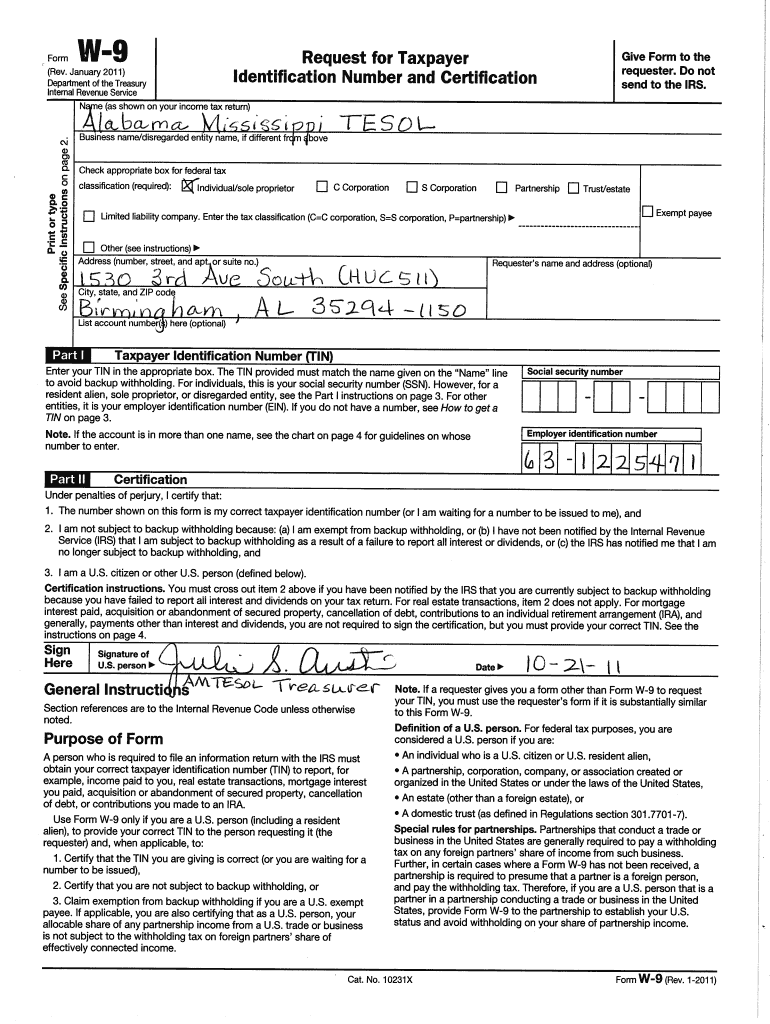

If you have already provided the requester an address and this is a new address write “new” at the top. This ensures that the information remains accurate and up. There are several ways to tell us your address has changed: Send, export, fax, download, or print out your document.

Updating Addres On W9 Form

Updating Addres On W9 Form

Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s. I'll impart insight and guidelines that could help you achieve this. Methods to change your address.

Use your new address when you file. Common mistakes and how to avoid them. Instead, an independent contractor’s clients report payments to the irs, and it’s up to the worker to.

What if your home address is different from your business address? Use the address that you will use on your tax return. Although you’ll often be supplied a copy of the form, you can also download the form from the irs site yourself.

Add text, images, drawings, shapes, and more.

IRS W9 Fillable Form ↳ W9 Tax Form for 2024 Free Blank PDF to Fill Out Online or Download

W9 Form Free Download Fillable & Printable PDF 2022 CocoDoc

Irs W9 Form 2021 Printable Calendar Template Printable

Printable W9 Form Pdf Printable Forms Free Online

W 9 Form For 2020 Printable Example Calendar Printable

Where Do You Send A W 9 Form

W9 Template 2022 Printable W9 Form 2023 (Updated Version)

What Is a W9 Form & How to Fill It Out

Downloadable W9 Tax Form

Non Fillable W9 Form Printable Forms Free Online

W9 Form 2023 Pdf Irs Printable Forms Free Online

Standard W 9 Form Printable Printable W9 Form 2023 (Updated Version)

Pdf Fillable W9 Form Printable Forms Free Online

How to complete IRS W9 Form W 9 Form with examples YouTube