Purpose Of W9 Forms

Purpose Of W9 Forms – The w9 form, officially known as the request for taxpayer identification number and certification, is a fundamental document used in the united states tax. Persons, including but not limited to: Request for taxpayer identification number and certification. The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income.

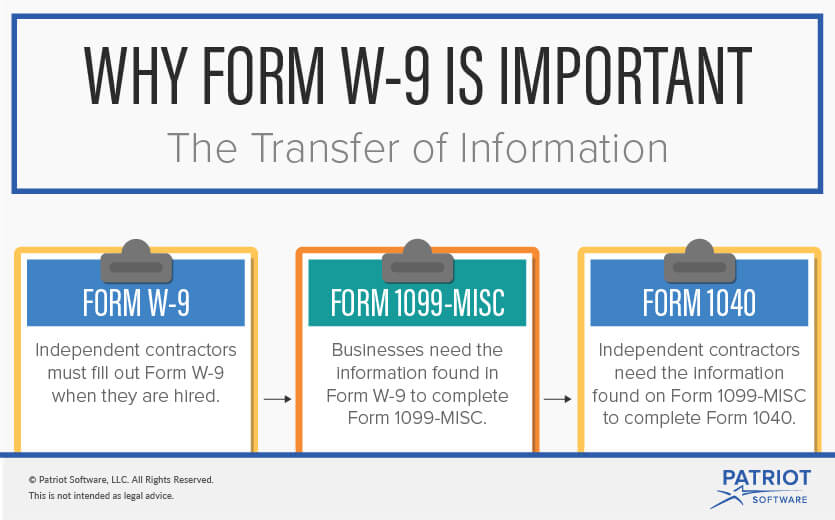

The request is made when you. March 2024) department of the treasury internal revenue service. Independent contractors who were paid at least $600 during the. W9 forms provide businesses with the tax information they need to complete and file form 1099—a type of information return that independent contractors use to file.

Purpose Of W9 Forms

Purpose Of W9 Forms

The w9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those contractors that you won’t be withholding. This includes their name, address, employer identification number, and. An individual who is a u.s.

IRS Form W9 — Iowa FAIR Plan Association

Fill And Sign W9 Form Online for Free DigiSigner

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88-008a20358ffc40d98c451e6cdea43c21.png)

W9 Tax Form

How To Guides Correctly completing an IRS Form W9 with examples Eamonn McElroy CPA, LLC

Know The Use And Purpose Of W9 Form littlelioness

How to Fill Out a W9 Form for a Nonprofit — Altruic Advisors

How to Submit Your W 9 Forms Pdf Free Job Application Form

What is a W9 and Do I Need One?

Free IRS Form W9 (2024) PDF eForms

W9 Tips and Common Errors CENTIPEDE Care Solutions a HEOPS Company

Understanding the Purpose of W9 Forms in the U.S.

What Is Form W9? Purpose and When to Use It

How to complete IRS W9 Form W 9 Form with examples YouTube

W9 Federal Withholding Form Printable W9 Form 2023 (Updated Version)