Irs.gov Non Profit W9 Form

Irs.gov Non Profit W9 Form – Tax exempt organization search tool. And contributions to an ira. Acquisition or abandonment of secured property; Form 990, return of organization exempt from income tax instructions for form 990

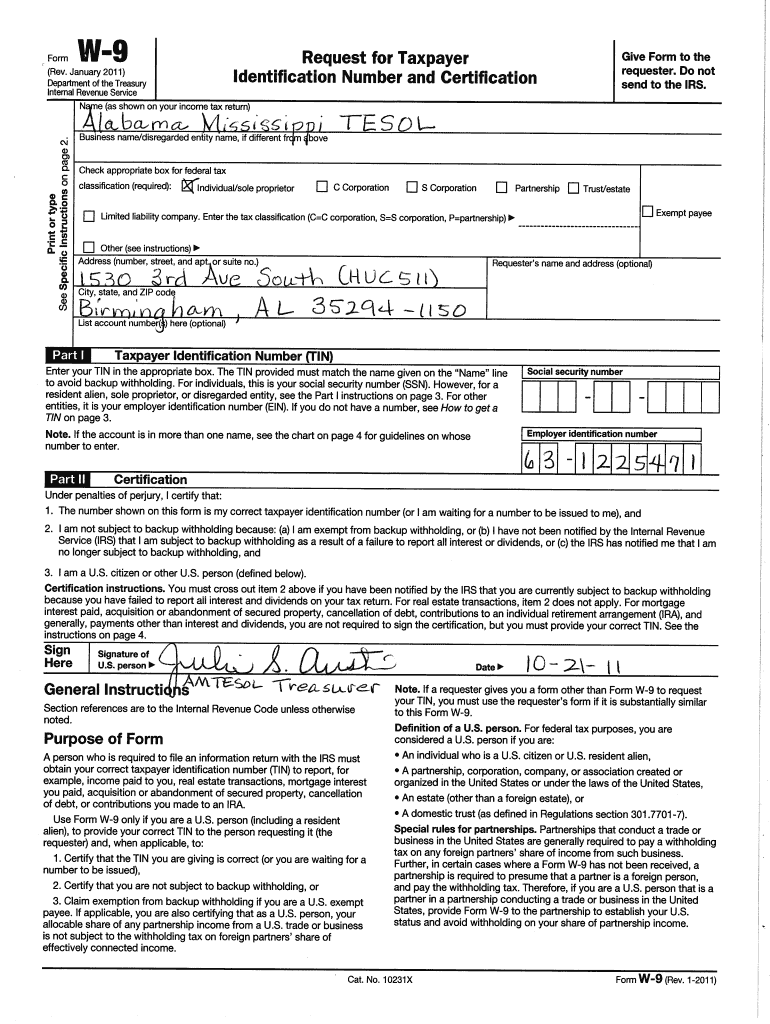

Irs form w9 is used by a taxpayer, usually a business, to obtain the social security number or federal employer tax id number from a person or business entity. This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: Independent contractors who were paid at least $600 during the year need to fill out a. Income tax return for certain political organizations, until march 17, 2024.

Irs.gov Non Profit W9 Form

Irs.gov Non Profit W9 Form

This article describes the new version. In the case of a disregarded entity with a u.s. Businesses are required to report many of these payments to the internal revenue service (irs).

Owner of the disregarded entity and not the disregarded entity.

Downloadable Form W 9 Printable W9 Printable Pages In 2020 With Free Riset

Irs W 9 Form 2020 Printable Pdf Example Calendar Printable Vrogue

Form W9 Pdf Fillable Printable Forms Free Online

Irs W9 Tax Form 2024 Toma Agnella

2005 Form IRS W9 Fill Online, Printable, Fillable, Blank pdfFiller

Free IRS Form W9 (2024) PDF eForms

How to Complete an IRS W9 Form YouTube

verdr Blog

Quick Video on w9 Form 10 Most Important Things You Must Know (2023)

How to complete IRS W9 Form W 9 Form with examples YouTube

Non Fillable W9 Form Printable Forms Free Online

Is It Safe To Fill Out A W9 Form Online W9 Form 2023 Fillable

Printable New I 9 Form Printable Forms Free Online

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice (EPostcard) 2019