Form W9 Line 3

Form W9 Line 3 – On line 3, select just one box. Check the appropriate box in line 3 for the u.s. If you do not have a business, you can leave this line blank. Updated january 16, 2024.

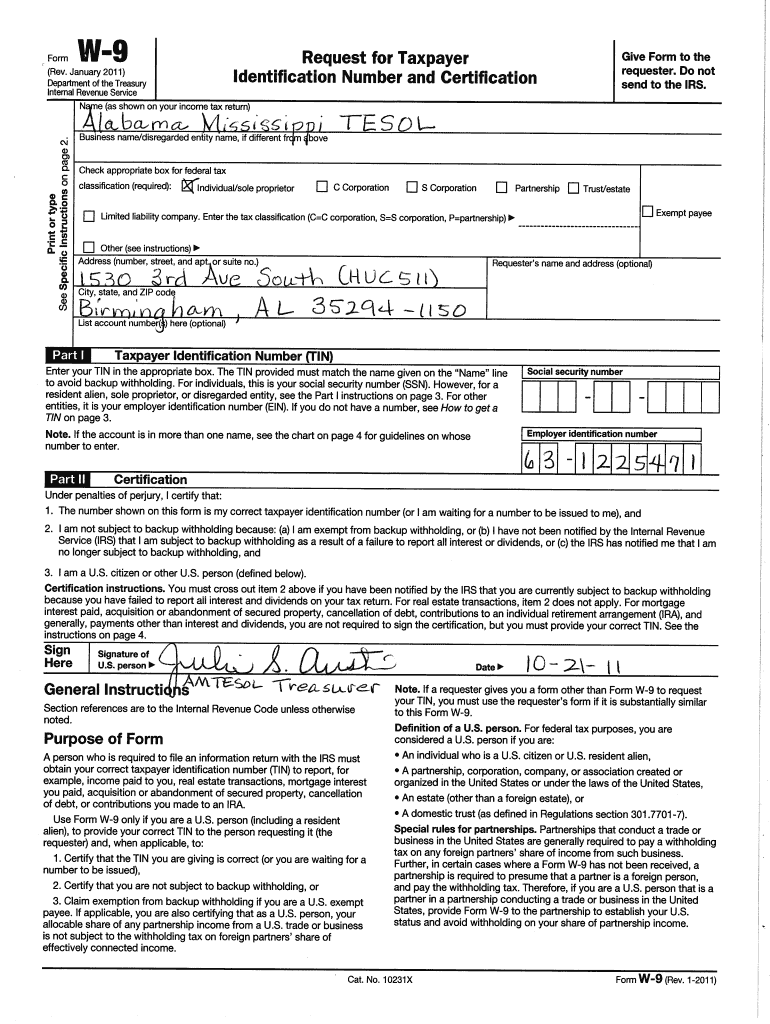

If you have a business name, trade name, dba name or disregarded entity name, fill it in here. Federal tax classification of the person or business whose name is entered on line 1. Then, write nonprofit corporation exempt under irs code section 501(c)(3).. Line 4 is for exemption.

Form W9 Line 3

Form W9 Line 3

Updated july 31, 2023. If this is the case, your name should be entered on. The irs requires companies to add up all the “reportable” payments made to vendors and independent contractors during the calendar year and report these payments to the.

This can be a social security number or the employer identification number (ein) for a business.; This form describes the contractor’s. The taxpayer identification number is correct.

Federal tax classification of the person whose name is entered on line 1. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not. Check the appropriate box for the u.s.

Free Online Fillable W9 Form Printable Forms Free Online

Form W9 India Dictionary

W9 Form What Is It, and How Do You Fill It Out? SmartAsset

Free IRS Form W9 (2024) PDF eForms

Irs Form W 9 Fillable Pdf Printable Forms Free Online

W 9 Form Pdf Online

How to Complete a W‐9 Tax Form 9 Steps (with Pictures)

W9 Form Fill Out and Sign Printable PDF Template signNow

How to Fill Out a W9 Form for a Nonprofit — Altruic Advisors

Printable W9 Form Pdf Printable Forms Free Online

Submitting w9 form with insurance claim to anthem Fill out & sign online DocHub

IRS W9 FORM STEPBYSTEP TUTORIAL How To Fill Out W9 Tax YouTube

Pdf Fillable W9 Form Printable Forms Free Online

Printable Print W9 Form