Employer Working With W9 Form

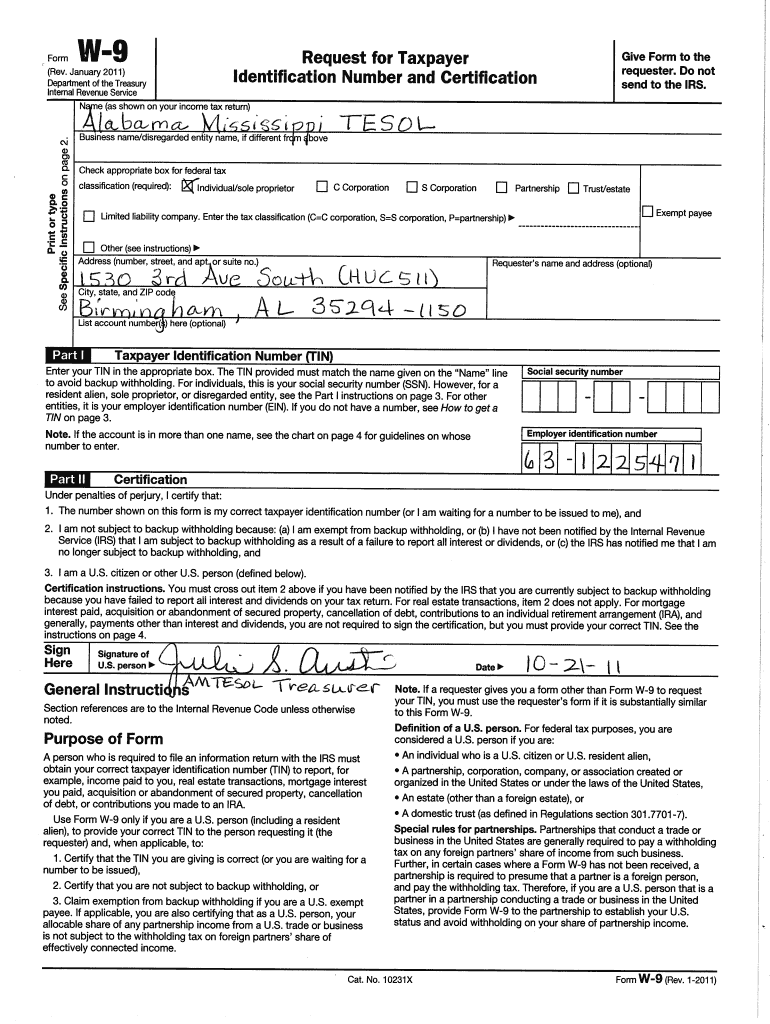

Employer Working With W9 Form – And contributions to an ira. The form requires an individual to provide their name, address, tax qualification, and withholding requirements. Updated on september 15, 2022. Give form to the requester.

If you want to be paid, refusing to hand. Morsa images / getty images. Section references are to the internal revenue code unless otherwise noted. Acquisition or abandonment of secured property;

Employer Working With W9 Form

Employer Working With W9 Form

Do not send to the irs. Go to www.irs.gov/formw9 for instructions and the latest information. March 2024) request for taxpayer identification number and certiication.

Instead, an independent contractor’s clients report payments to the irs, and it’s up to the worker to. The form requires a taxpayer to provide. This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:

Request for taxpayer identification number and certification.

Pdf Fillable W9 Form Printable Forms Free Online

Nys W9 Printable Forms For 2021 Calendar Template Printable

Free Printable Job W9 Form Example Calendar Printable

Printable W9 Form for W9 Tax Form 2016

W9 Federal Withholding Form Printable W9 Form 2023 (Updated Version)

What is a W9 Used for Form Fill Out and Sign Printable PDF Template airSlate SignNow

IRS W9 2021 in 2021 Retirement strategies, Employer identification number, Irs

Printable W9 Form Pdf Printable Forms Free Online

Instructions on How to Accurately Complete the Required W9 Form YouTube

Irs W9 Form 2021 Printable Calendar Template Printable

W9 vs 1099 IRS Forms, Differences, and When to Use Them 2019 Best Practice in HR

W9 Form SDocs for Salesforce

W9 Form 2023 Printable W9 Form 2023 (Updated Version)

W9 Template 2022 Printable W9 Form 2023 (Updated Version)