Emailing Bluedot-Independent-Contractoragreement-W9-Form.pdf

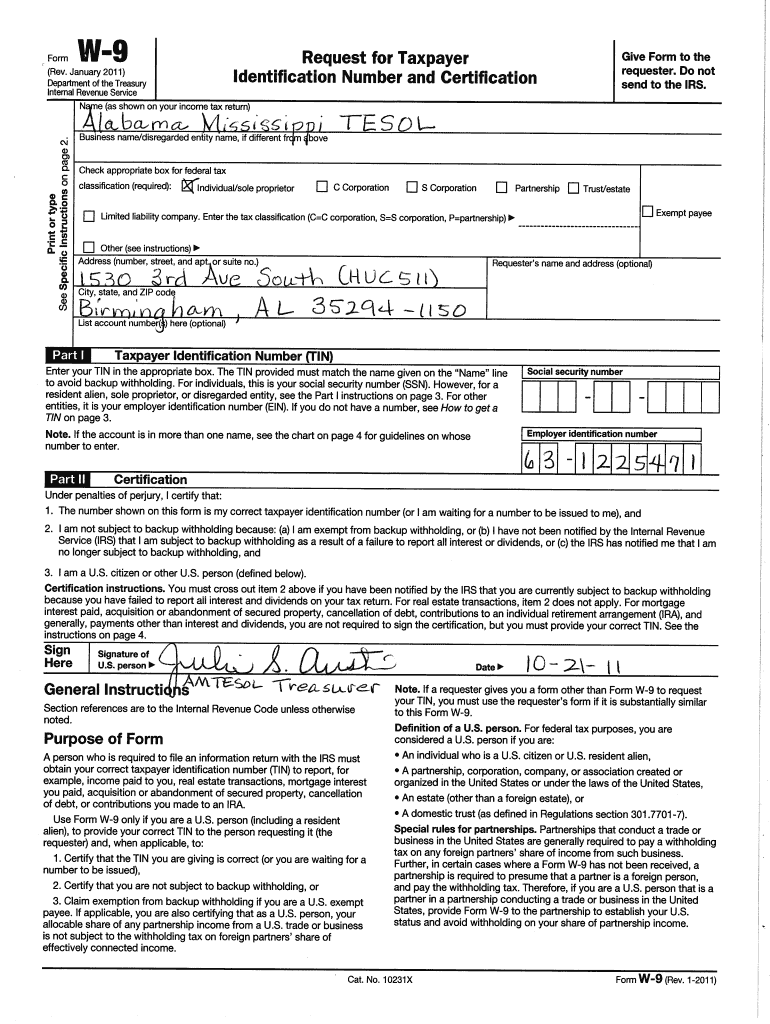

Emailing Bluedot-Independent-Contractoragreement-W9-Form.pdf – Nonemployees complete this form by providing their taxpayer identification numbers (tins), names, addresses, and other information. The w9 is a formal request for information about the contractors you pay, but more significantly, it is an agreement with those contractors that you won’t be withholding income tax from their pay—contractors must pay their own taxes on this income. Last updated february 5th, 2024. The form asks for information such as the ic's name, address, social security number (ssn), and more.

Protect the confidential information by sending it via an encrypted email, by hand delivery, or by mail. It is commonly required when making a payment and withholding taxes are not being deducted. Usually an independent contractor (sometimes called a freelancer) works on a certain project or for a short period of time. An independent contractor agreement is a contract in which a company hires someone without employing them.

Emailing Bluedot-Independent-Contractoragreement-W9-Form.pdf

Emailing Bluedot-Independent-Contractoragreement-W9-Form.pdf

Give form to the requester. This independent contractor agreement (the “agreement”) is made and entered into by and between blue dot real estate and , a(n) individual (the “independent contractor”). The contractor is responsible for taxes, insurance, and more (not provided employee benefits)

Request for taxpayer identification number and certification. March 2024) department of the treasury internal revenue service. Independent contractors who were paid at least $600 during the year need to fill out a.

An independent contractor agreement is a legally binding document between the contractor and client that sets forth the terms and conditions for which work is to be completed. The independent contractor agreement is there to hold all parties accountable for the success of the agreed work. Independent contractors have fewer directions and use their own expertise and judgment to perform their work.

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench throughout 2021 W9 Form in 2021 Irs

Independent Contractor Subcontractor Agreement Sample PDF Template

Free 1Page (Simple) Independent Contractor Agreement Template PDF Word

Independent Contractor Agreement Template Free

Free Printable Contractor Agreement Printable Templates

Pdf Fillable W9 Form Printable Forms Free Online

Independent Sales Contractor Agreement Template

Independent Contractor Agreement Template Legal Templates

50 Simple Independent Contractor Agreement Templates

To Be Completed by All 1099s Independent Contractor Agreement & W9 Form. Sign Below PDF

Free Fillable Independent Contractor Form Printable Forms Free Online

Fillable Online are w9 forms for independent contractors FILLABLE W9 Fax Email Print

Free Independent Contractor Agreement Template Word

50+ FREE Independent Contractor Agreement Forms & Templates