Do Trusts File W9 Forms

Do Trusts File W9 Forms – See instructions for part ii of form 3520. So i'm guessing john smith goes on line 1. Estate planning attorney in torrance, ca. If it is a irrevocable trust, or more trustees, or something more complex, you would file for a separate tax id number and i suspect this makes the databases happy.

In order to avoid penalties under section 6677, the u.s. Helpful (0) 5 lawyers agree. See what is backup withholding, later. If you are appointed the trustee of a revocable trust, you are responsible for administering the trust.

Do Trusts File W9 Forms

Do Trusts File W9 Forms

Person (including a resident alien), to provide your correct tin. I put in my social security number which is the identifying number for my revocable trust. | licensed for 28 years.

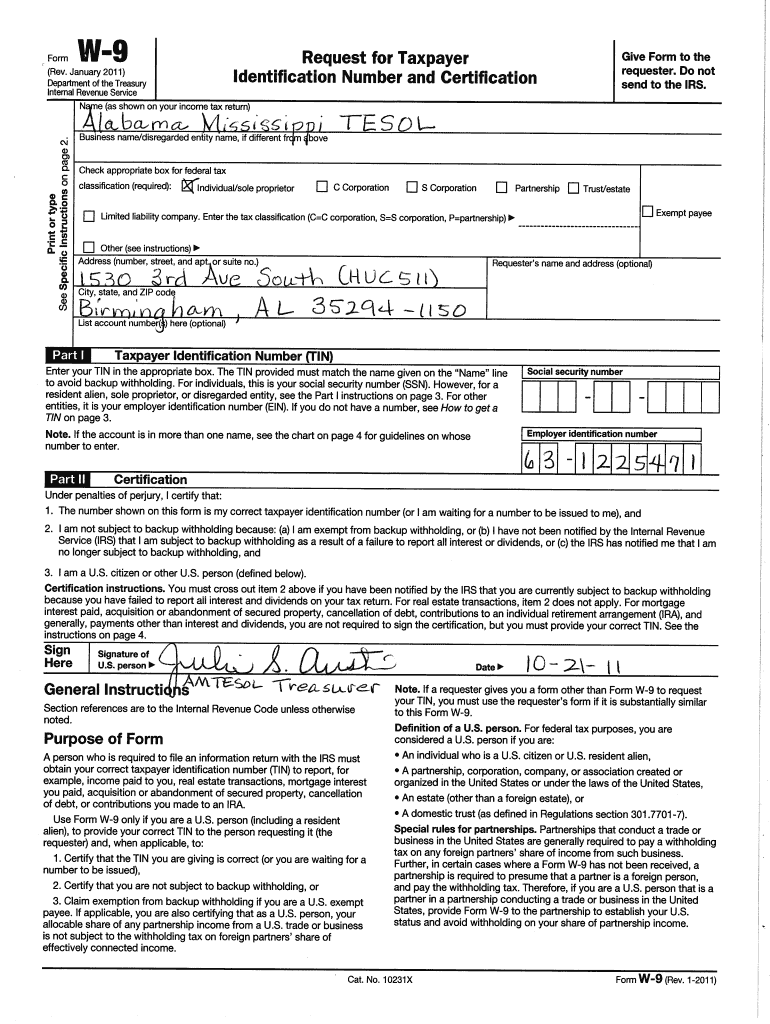

If you are receiving income or benefits from a family trust, those benefits are generally taxable. Acquisition or abandonment of secured property; Under federal tax classification, i checked trust/estate.

And contributions to an ira. Use form 1042 to report tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts.

W9 What Is It and How Do You Fill It Out? SmartAsset

W9 Form 2024 Fillable Gusti Katrine

How do I fill out IRS Form W9 for my IRA LLC? Rocket Dollar

What Is a W9 Form & How to Fill It Out

How To Guides Correctly completing an IRS Form W9 with examples Eamonn McElroy CPA, LLC

Pdf Fillable W9 Form Printable Forms Free Online

Quick Video on w9 Form 10 Most Important Things You Must Know (2023)

What is Form W9 & How You File It? TaxBandits YouTube

How to complete IRS W9 Form W 9 Form with examples YouTube

How To Fill Out A W9 For An Llc Partnership? The Mumpreneur Show

What is a W9 Form & Why You Need To Fill It Out Bench Accounting

The IRS Form W9 A Beginning Guide JTC CPAs

How to Submit Your W 9 Forms Pdf Free Job Application Form

Free IRS Form W9 (2024) PDF eForms