Do Nonprofits Have W9 Forms

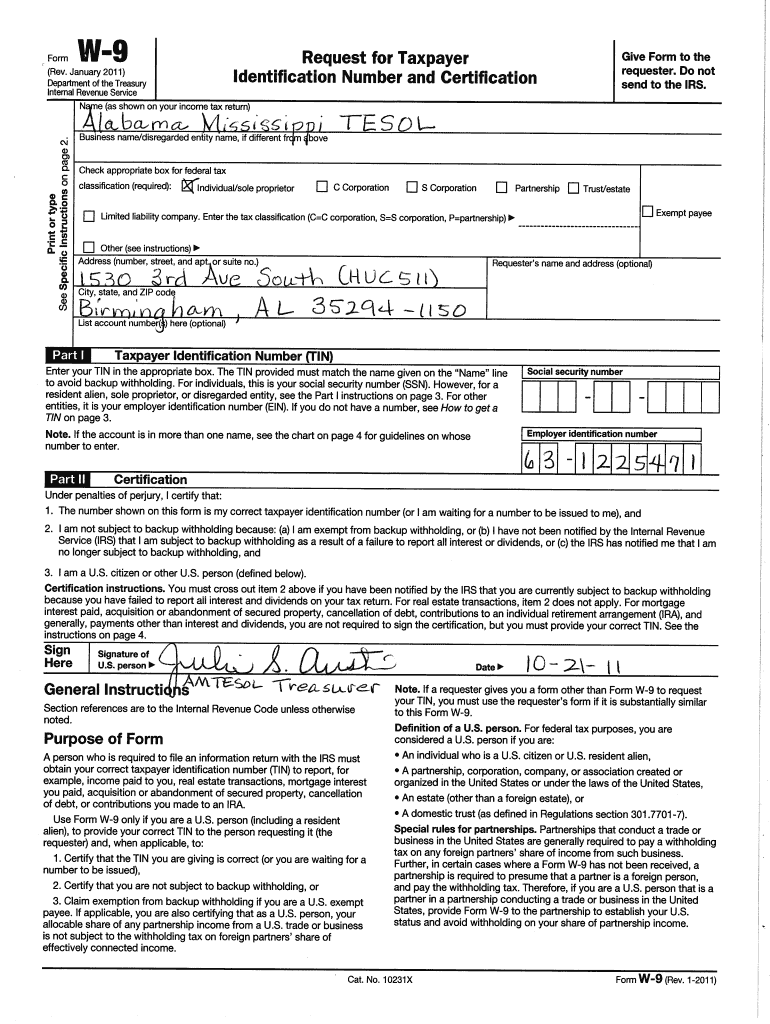

Do Nonprofits Have W9 Forms – Person (including a resident alien) and to request certain certifications and claims for exemption. This form is essential for providing the requesting organization with your taxpayer identification number (tin) and other necessary details. Give form to the requester. Irs form w9 is used by a taxpayer, usually a business, to obtain the social security number or federal employer tax id number from a person or business entity.

Taxpayer information (name, address, tax. Do not send to the irs. Your first step is to make sure you understand what the form is used for. Go to www.irs.gov/formw9 for instructions and the latest information.

Do Nonprofits Have W9 Forms

Do Nonprofits Have W9 Forms

If you need help, please contact us. And to answer a common question: Request for taxpayer identification number and certification.

How to Fill Out Form W9 for a Nonprofit The Charity CFO

How to Fill Out a W9 for Nonprofits Jitasa Group

How to complete IRS W9 Form W 9 Form with examples YouTube

Free IRS Form W9 (2024) PDF eForms

How to Complete a W‐9 Tax Form Taxes Tips Wiki English

How to Fill Out a W9 Form for a Nonprofit — Altruic Advisors

Blank Printable W9 Form

Is It Safe To Fill Out A W9 Form Online W9 Form 2023 Fillable

Fill And Sign W9 Form Online for Free DigiSigner

Quick Video on w9 Form 10 Most Important Things You Must Know (2023)

W9 form Detailed guide on how to fill out and sign AZ Big Media

Free Online Fillable W9 Form Printable Forms Free Online

W9 Form Free Download Fillable Printable PDF 2022 CocoDoc, 51 OFF

Pdf Fillable W9 Form Printable Forms Free Online