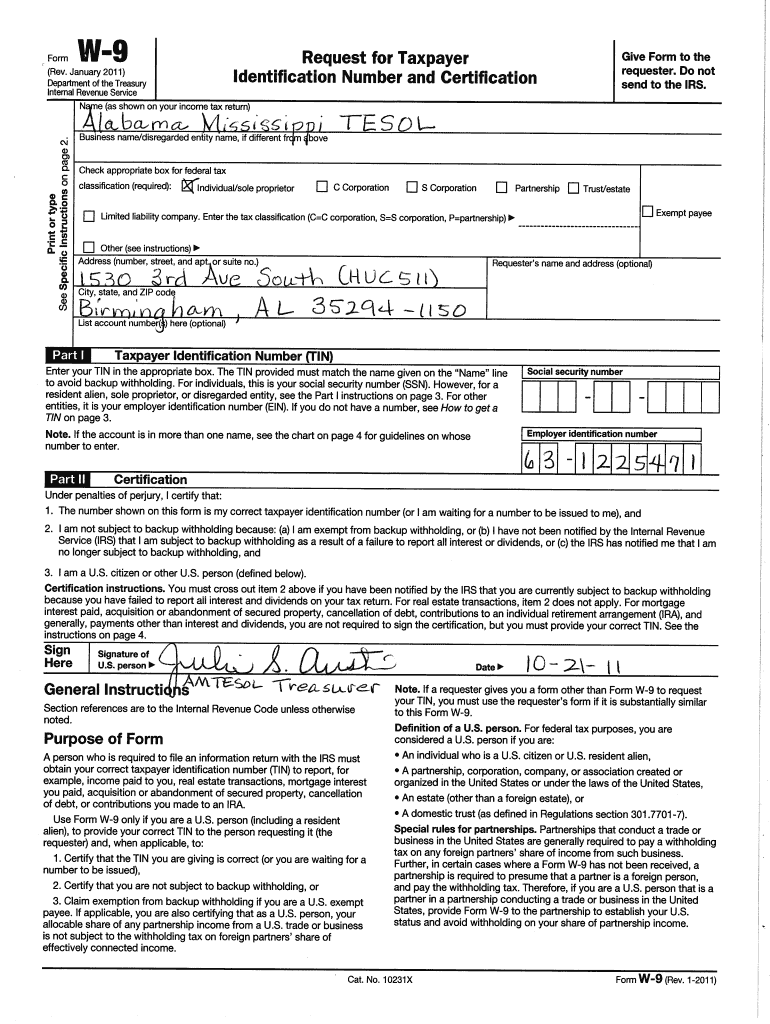

Do Corporation W9 Form

Do Corporation W9 Form – Irs form w9 is used by a taxpayer, usually a business, to obtain the social security number or federal employer tax id number from a person or business entity. If you are a u.s. The main difference between c and s corporations is the tax treatment. It depends on whether you're an independent contractor or an employee.

Independent contractors who were paid at least $600 during the year need to fill out a. Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s. Acquisition or abandonment of secured property; You need to use it if you have earned over $600 in that year without being hired as an employee.

Do Corporation W9 Form

Do Corporation W9 Form

Store copies you've received and transmit copies. And contributions to an ira. This form is used to provide the correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example:

One of the most common situations is when someone works as.

How To Guides Correctly completing an IRS Form W9 with examples Eamonn McElroy CPA, LLC

Quick Video on w9 Form 10 Most Important Things You Must Know (2023)

Guide To Tax Form W9 (US) Deel

w9 forms 2019 printable PrintableTemplates

What Is a W9 Form & How to Fill It Out

Printable W9 Form Pdf Printable Forms Free Online

How to Fill W9 Form YouTube

W 9 Printable Form Example Calendar Printable

W9 Tips and Common Errors CENTIPEDE Care Solutions a HEOPS Company

Fill And Sign W9 Form Online for Free DigiSigner

W 9 Form 2022

W9 Form 2024 Fillable Gusti Katrine

2020 W9 Printable Form Example Calendar Printable

Pdf Fillable W9 Form Printable Forms Free Online